Uncategorized

-

Lesson 9: Trading Psychology – Mastering Your Mind in the Market

Objective: Strengthen the mindset that keeps you disciplined, consistent, and focused during uncertainty. 1. Understand Your Emotional Triggers Identify what sets you off:• Fear of missing out• Fear of loss• Revenge trading• ImpatienceOnce you understand your triggers, you can control them instead of reacting to them. 2. Accept That Losses Are Part of the Game…

-

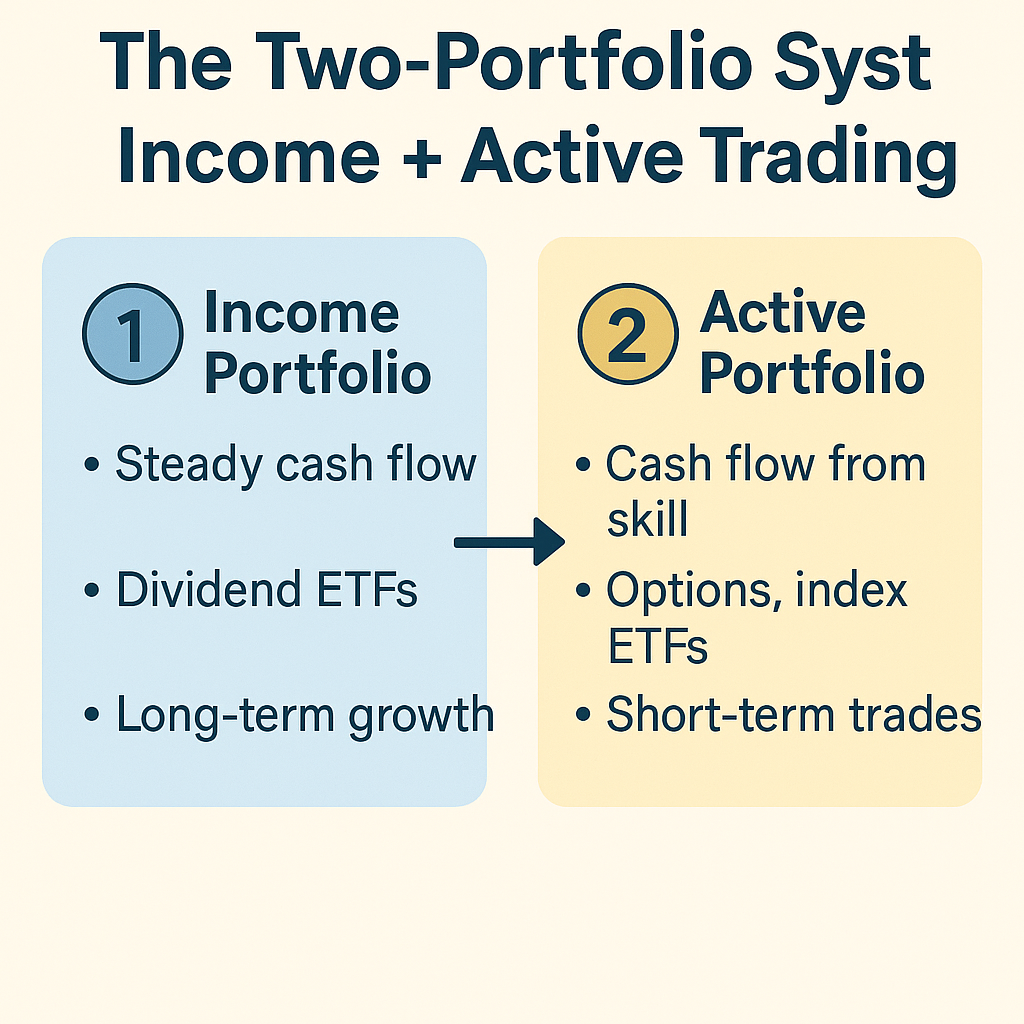

The Two-Portfolio System: Income + Active Trading

Student Lesson Lesson: The Two-Portfolio System 1. Income Portfolio (The Foundation) 2. Active Portfolio (The Weapon) 3. Why It Works

-

Lesson 8: Adapting to Market Conditions

1. Why Adaptability MattersThe market’s personality changes — what works in one phase fails in another. Your edge must evolve with volatility, volume, and sentiment shifts. Rigid traders break; adaptable ones thrive. 2. Market Environments 3. Reading Context 4. Adjusting Your Strategy 5. Evolving With DataKeep a separate tab in your journal for market conditions.Note…

-

Lesson 7: Emotional Control & Trader Psychology

1. The Inner BattleMost traders lose not because of bad setups, but because of emotional reactions. Fear, greed, hesitation, and revenge trading are account killers. Mastering your emotions = mastering your edge. 2. Recognizing Emotional States 3. The Discipline Framework 4. Reset RitualsWhen emotions spike — pause, breathe, and reset.Step away from the screen, stretch,…

-

Lesson 6: Developing Your Trading Edge

1. What Is an Edge?An edge is a repeatable condition that tilts probability slightly in your favor. It’s not luck — it’s data, structure, and discipline working together. 2. Components of a Real Edge 3. Common Sources of Edge 4. Sharpening Your Edge 5. Sustaining It Over TimeThe market evolves — so must your edge.Refine,…

-

Lesson 5: Trade Review & Journaling

1. Why Review MattersA trade journal is your mirror. It shows patterns you can’t see in real time — strengths, weaknesses, and emotional triggers. 2. What to Record 3. Metrics That Matter 4. Review Routine 5. Mindset ShiftLosing trades are data points, not failures. Every chart you log is a page in your playbook. Journaling…

-

Lesson 4: Trade Execution & Timing

1. The Importance of PrecisionExecution separates analysis from results. You can have the perfect setup, but poor timing or hesitation can turn a winning trade into a loss. 2. Entry Timing 3. Scaling In and Out 4. Stop-Loss Placement 5. Execution Discipline 6. SummaryExecution isn’t about speed — it’s about precision and trust in your…